5 Tips to Cut Back on Spending During COVID-19

Would you like to know some tips to Cut Back on Spending During the COVID-19 pandemic?

Tips to Cut Back on Spending During COVID-19

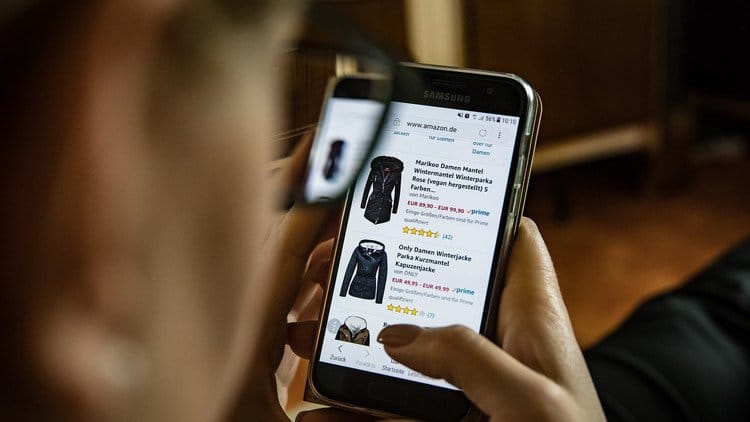

There have been a few upsides to COVID-19. You’ve caught up on your latest shows, you fixed the squeaky kitchen cupboard, and you even finished that book you were putting off. Free from distraction, we’ve been getting stuff done. But it’s also a great chance to start saving. It’s too easy to bulk buy off Amazon or to treat yourself at the supermarket. But use your head and be sensible, and you could leave the crisis with money in the bank.

Keep Track your finances

How do you cut back if you don’t even know what you’re spending? It’s far too easy to lose track of your finances, especially in a world of contactless payments. But it’s important to know what’s coming in and what’s going out. Plus, by merely recognizing what you have, you’re less likely to indulge.

Keep track of your spending for 30 to 60 days to prepare for a budget. Some great apps can help! Or stick to the basics with a spreadsheet. Make sure to note every purchase down.

Make a Budget

Stopping spending is easy in theory. Just do it. Unfortunately, many purchases that seemed innocent at the time, soon start adding up. That’s why you need a budget. You can make it as detailed as you like, but make sure to note down the basics. Work out if you have any disposable income, and how much you want to save.

The pandemic offers a chance to evaluate our choices. Find any purchases or subscriptions you don’t need and cancel them. If you’ve got a gym membership you don’t use, now’s the time to workout at home.

Give Yourself a Rule

A simple rule can stop you from making stupid purchases. A 24-hour rule is commonly used. If you’re going to buy an item over a specific price, spend 24-hours considering whether to buy it. Mix it up, try waiting a day for every $100 you’re planning to spend. If the items are worth it, they can wait.

No-spend days are another excellent rule for keeping your spending under tabs. With nowhere to go and nothing to do, try to tailor your week to be mostly no-spend days.

Top tip: delete Amazon from your bookmarks (and unsubscribe from mailing lists).

Recommended for You: How Conflict Styles Hurt Relationships?

Hunt for a Bargain

If you do need to make a purchase online, keep your eyes peeled for a bargain. Sites such as Klip2Save and Bargain Coupon Clippers provide a great source of coupons and vouchers for use in-store. Check out Honey for online purchases; it’s a browser extension that searches for coupon codes automatically.

Plan for a Splurge

We all need to splurge once in a while. Life is for enjoying. Therefore, plan your splurges and link them to your saving. For instance, if you save a certain amount, then get yourself the purchase you’ve been craving. Or, if you make an impulse buy, save a percentage of the total (e.g., 30%) in your savings account.

Cutting spending can be easy if you keep organized. Follow these 5 Tips to Cut Back on Spending During COVID-19

Josh Dudick

Josh is the owner and lead writer at Daily Wisely. His career has taken him from finance to blogging, and now shares his insights with readers of Daily Wisely.

Josh's work and authoritative advice have appeared in major publications like Nasdaq, Forbes, The Sun, Yahoo! Finance, CBS News, Fortune, The Street, MSN Money, and Go Banking Rates. Josh has over 15 years of experience on Wall Street, and currently shares his financial expertise in investing, wealth management, markets, taxes, real estate, and personal finance on his other website, Top Dollar Investor.

Josh graduated from Cornell University with a degree from the Dyson School of Applied Economics & Management at the SC Johnson College of Business.